Buying a property at foreclosure can be a steal of a deal if you know where to look and how to go through with the purchase.

Since Illinois is a judicial state, investing in a foreclosure property needs to be done in phases.

No matter the stage of foreclosure, the biggest advantage for an investor is the drastically reduced price for a property. Since there can be huge savings, you may be wondering why people aren’t tripping head over heels to get them — yourself included perhaps!

Foreclosure property investments has seen a huge jump among real estate investments so yes, there is staunch competition. The only way to get ahead of the game is to fully understand the foreclosure process by relying on updated and precise data/research.

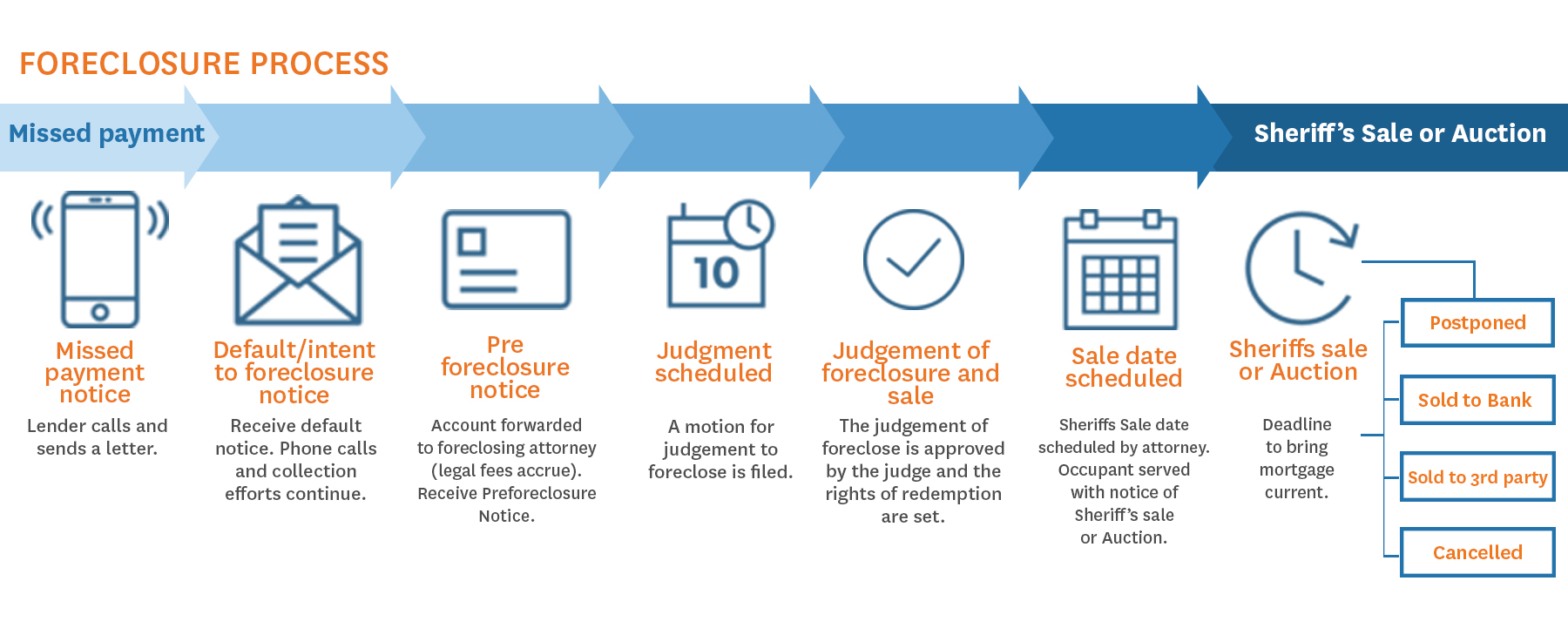

Let’s start with the general foreclosure process timeline:

There are many different pros and cons for purchasing a foreclosure property at different times. For example, buying during the pre-foreclosure stage (also known as a short sale) puts you at a great negotiation position and you can inspect the property. Then during the foreclosure auction, you may not be able to tour the property but that is easily offset by the fact that some taxes and liens actually get completely wiped out once the foreclosure goes to auction. (See my previous article about auctions/sheriff sales to get a better understanding of auctions!)

Finding a foreclosure property is not hard — there are, after all, close to 2000 new cases monthly in the Chicagoland counties. The tricky part is making sure you get the most accurate data. With nationwide databases, you’ll be able to search all around the country but services like this really focus on quantity over quality. Researching with a local listing service is definitely your best shot at finding an amazing deal!

But what really constitutes a great deal and how can you be sure you’re getting one?

Let’s take a look at how to read foreclosure case data.

- The key components to look for are the balance due on the defaulted mortgage and what position that mortgage is in. This is because purchasing any subsequent mortgage in foreclosure forces you to also purchase the first mortgage in order to own the property. As such, it’s usually advised that you avoid buying anything other than a first mortgage (for both auctions and short sales).

On ILFLS, any other mortgages or owed taxes can be found under “subsequent liens”. Additionally, looking for any associated cases will give you even more information. Those links are also provided. - Another quick tip is to make sure you check for any additional defendants on a foreclosure case, especially any home/condo/townhome associations, as you may need to pay HOA fees upon your property purchase. On ILFLS, this is located under the “additional defendants” section. A quick Google search will get you the phone number for the association and they’ll tell you exactly how much you owe.

This should also be repeated by calling the city in which your future investment is located in order to check for water bills and/or zoning violations.

Once you’ve diligently completed your research on a foreclosure property and you’re ready to make some investment money, you’ll need to gather your funds and decide on a purchase strategy, as well as an exist strategy (also check out my previous article on investment blunders to avoid!). Purchase strategies include short sales, foreclosure auctions, and purchasing from a bank after the property has already been foreclosed on. Exit strategies include buying/holding for renting and fixing/flipping for a quick sale.

Stay tuned for more helpful tips, guides, and insights!

Happy investing!

Start your investing journey by subscribing for one of the ilFLS Freebies: Weekly Email Alerts